When you pick up a generic pill at the pharmacy, you probably don’t think about how it got there. But behind that small tablet is a high-stakes economic puzzle: how do companies keep life-saving drugs cheap, available, and reliable when profit margins are thinner than ever? The answer lies in supply chain efficiency-a make-or-break factor in generic drug distribution today.

The Affordability Paradox

Generic drugs are supposed to be affordable. That’s the whole point. But the pressure to keep prices low has created a dangerous trade-off. As manufacturers compete to offer the cheapest version of a drug, margins shrink. The average EBITA margin for generic distributors dropped from 12.5% in 2018 to just 8% in 2022. That’s not enough to absorb shocks. Here’s the twist: the cheapest generics are also the most likely to run out. According to Drug Patent Watch’s 2023 analysis, low-priced generics face a 73% higher risk of shortage than higher-priced ones. Why? Because when profits are razor-thin, companies cut corners. They eliminate backup suppliers. They reduce safety stock. They rely on a single factory in India or China to make the active ingredient. One factory outage, one shipping delay, one regulatory inspection-and the drug vanishes from shelves.What Efficiency Really Means in Generic Distribution

Efficiency isn’t just about cutting costs. It’s about doing more with less-without breaking. Top performers in this space don’t just work faster. They work smarter. They use the Economic Order Quantity (EOQ) formula: Q = √(2KD/G). Sounds technical? It’s not. It’s just math that balances how often you order medicine against how much it costs to store it. Leading distributors using this model cut stockouts by 30-45%. That means fewer patients go without their medication, and fewer pharmacies pay premium prices for emergency shipments. They track performance with hard numbers:- Overall Equipment Effectiveness (OEE): How well a manufacturing line runs. Top distributors hit 85%+. The industry average? 68-72%.

- Perfect Order Percentage: The percentage of orders delivered on time, complete, undamaged, and correctly documented. Leaders aim for 95%+. Most struggle to hit 80%.

- Order cycle time: How long it takes from order to delivery. The best cut this down to under 24 hours for critical generics.

Technology Is the New Backbone

You can’t manage a modern generic supply chain with spreadsheets and phone calls. The tools now in use are making a real difference.- Cloud-based ERP systems give real-time visibility across warehouses, transport, and suppliers. Cardinal Health’s $150 million investment in predictive analytics helped them gain 3.2% market share in 2022 alone.

- IoT sensors monitor temperature and humidity during transport. Why? Because 45% of generic drugs need climate control. A single shipment spoiled by heat can mean a hospital emergency.

- AI forecasting replaces guesswork. Traditional models used past sales data. That failed when demand spiked suddenly-like during a flu outbreak or a recall. AI tools now reduce prediction errors by 25-40%. McKesson’s new ‘DemandSignal’ platform cut forecast errors by 37% in early trials.

Just-in-Time vs. Just-in-Case: The Balancing Act

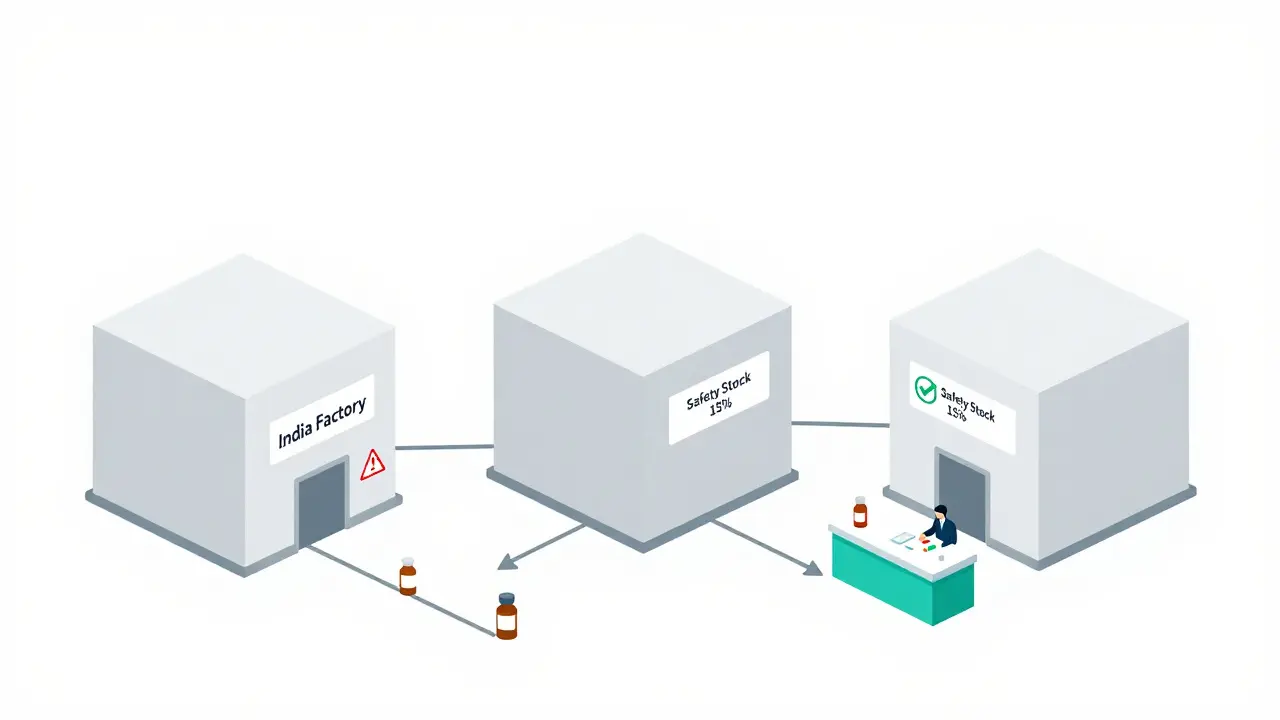

There are two main approaches to inventory in generic distribution:- Just-in-Time (JIT): Order only what you need, when you need it. Reduces storage costs by 22-35%. Sounds perfect-until the factory shuts down. JIT increases stockout risk by 15-20% during disruptions.

- Just-in-Case (JIC): Keep extra stock on hand. Increases holding costs by 18-28%, but cuts stockouts by 40-60%.

Who’s Winning and Who’s Falling Behind

Three giants-McKesson, AmerisourceBergen, and Cardinal Health-control 85% of U.S. generic distribution. And they’re pulling away from everyone else. Why? Because they’re investing in efficiency. Top quartile distributors now hit 9.2% EBITA margins. Bottom quartile? Just 6.8%. That 2.4-point gap isn’t just numbers. It’s the difference between staying in business and getting bought out. Smaller distributors are getting squeezed. AI tools cost millions to implement. Blockchain traceability? $2.5-4 million for mid-sized players. Legacy systems? Hard to upgrade. Many still rely on paper logs and fax machines. The gap is widening fast. Morgan Stanley predicts that by 2027, only those with integrated digital twins of their supply chains will survive. That’s a system that simulates every step-from factory to pharmacy-in real time, predicting disruptions before they happen.Regulations Are Raising the Bar

It’s not just competition driving change. Rules are forcing it. The FDA’s Drug Supply Chain Security Act (DSCSA) requires full electronic traceability of every drug package by 2023. That means every bottle, every box, every pallet must be tracked digitally. Same in Europe under the Falsified Medicines Directive. Compliance adds 5-10% to operational costs. But it’s not optional. Non-compliance means fines, recalls, or worse-being banned from selling. Ironically, these regulations are helping the efficient players. Big distributors already had the systems. Smaller ones are scrambling. That’s accelerating consolidation.

What Gets in the Way

Even when companies know what to do, they struggle to do it.- Legacy systems: 65% of companies say integrating old software with new analytics tools adds 6-9 months to deployment.

- Approval bottlenecks: One distribution manager on Reddit said too many layers of management delayed supplier quote changes-leading to 22% more expensive emergency shipments.

- Skill gaps: 87% of hiring managers say advanced analytics skills are the top requirement. But few supply chain teams have data scientists.

What’s Next

The future belongs to those who treat their supply chain like a living system-not a cost center. McKinsey predicts a 40-50% surge in network optimization spending over the next 18 months. Distributors will start offering wider selections of SKUs, not just the cheapest options. They’ll compete on reliability, not just price. By 2027, MIT projects that top distributors will operate with digital twins-virtual copies of their entire supply chain. These systems will predict demand with 95%+ accuracy and slash inventory costs by half, all while keeping service levels above 99%. The message is clear: if you’re still managing generic drug distribution like it’s 2010, you’re already behind. Efficiency isn’t a nice-to-have anymore. It’s the only way to stay alive.Why are generic drug shortages getting worse even though prices are lower?

Lower prices force manufacturers to cut costs everywhere-especially in redundancy. Many generics are made in just one or two factories globally. When one shuts down for maintenance, inspection, or a power outage, there’s no backup. With thin margins, companies can’t afford to build extra capacity or stockpile safety inventory. So when demand spikes or a supplier fails, the drug disappears.

Can AI really prevent generic drug shortages?

Yes, but not alone. AI predicts demand more accurately than old methods by analyzing not just past sales, but also hospital admission trends, prescription changes, and even social media mentions of drug recalls. Companies like McKesson have cut forecast errors by 37% using AI. But AI needs good data and fast action. If the system flags a coming shortage but procurement teams take weeks to respond, the AI won’t save the supply chain. It’s a tool, not a magic fix.

Is just-in-time inventory safe for generic drugs?

It’s risky for essential generics. Just-in-time works for non-critical drugs with steady demand, like allergy pills. But for antibiotics, heart meds, or insulin, keeping zero safety stock is dangerous. Studies show 68% of distributors who eliminated all buffer inventory faced severe shortages. The smart approach: use JIT where you can, but always keep at least a 15% buffer for high-use, low-margin drugs.

Why do some distributors spend millions on supply chain tech while others don’t?

It’s about scale and survival. Big distributors like Cardinal Health and McKesson handle billions in sales. A 1% efficiency gain saves millions. For them, a $20 million investment pays off fast. Smaller distributors can’t afford it. They’re stuck with outdated systems, slower responses, and higher stockout rates. This is creating a two-tier system: efficient giants and struggling leftovers.

How do regulations like DSCSA affect generic drug supply chains?

They raise the cost of doing business-but also raise the bar for who can compete. DSCSA requires every drug package to be tracked electronically from factory to pharmacy. That means barcodes, digital logs, and secure data sharing. Big companies already had systems in place. Smaller ones had to upgrade or face penalties. The result? More consolidation. Compliance adds 5-8% to costs, but it also weeds out weaker players who can’t keep up.

Gray Dedoiko

December 22, 2025 AT 19:27Been working in pharma logistics for 12 years. This post nails it. The real tragedy isn't the price drop-it's the patients who go without because someone cut the last safety stock. I've seen it firsthand. A nurse once cried in my office because she couldn't get her kid's antibiotic. No one was to blame. Just a system designed to fail.

Aurora Daisy

December 23, 2025 AT 17:18Oh wow. So now we're impressed that American corporations figured out how to squeeze pennies out of dying people? Congrats. You're basically proud that your healthcare system turns lifesaving drugs into a game of Russian roulette with a 73% chance of losing. Bravo. Send me your tax return so I can laugh harder.

Paula Villete

December 25, 2025 AT 08:03AI doesn't fix broken systems. It just makes the failure faster and more predictable. And honestly? The real villain here isn't the distributors-it's the FDA and Congress letting single-source manufacturing become the norm. One factory in India makes 80% of our amoxicillin? That's not efficiency. That's a national security risk dressed up as a balance sheet. Also, typo: 'EBITA' should be 'EBITDA'. But I'll let it slide. You're trying.

Georgia Brach

December 26, 2025 AT 18:17Statistical cherry-picking. EBITA margins are misleading without context. The industry is saturated. Price competition is inevitable. You're attributing systemic failure to operational inefficiency when the root cause is regulatory capture and monopolistic consolidation. Also, the term 'digital twin' is marketing jargon. It's just a fancy simulation. Don't confuse complexity with competence.

Payson Mattes

December 26, 2025 AT 22:28Wait wait wait. You know who really controls the generic supply chain? Big Pharma. They own the patents, then sell the rights to the cheapest bidder. Then they buy up the distributors. Cardinal Health? Owned by a hedge fund that also owns a major Indian API plant. The shortages? Planned. So prices can spike again later. They want you scared. So you'll pay $500 for insulin next year. I've seen the emails. They're not accidents. They're strategy.

siddharth tiwari

December 27, 2025 AT 19:33india make 70% of world's generic drugs. why u think we have shortage? because usa stop import from china and india now? no. because u want to blame tech and not your own gov. my cousin work in a factory in telangana. 12hr shift. 300rs/day. they make 500k pills a day. and u say efficiency? they dont even have clean water. u want efficiency? pay them more. then maybe they dont quit and leave the line.

Diana Alime

December 29, 2025 AT 18:52So let me get this straight… we’re supposed to be impressed that a system designed to make medicine cheap is now collapsing because it’s TOO cheap? And the solution is MORE tech? MORE money? MORE corporate consolidation? Ugh. I just want my blood pressure pills to exist. That’s it. Not a lecture on EOQ formulas. Not a TED Talk on digital twins. Just… pills. Please.

Adarsh Dubey

December 30, 2025 AT 04:21Interesting read. I think the real insight is that efficiency isn’t the opposite of resilience-it’s its foundation. But only if it’s built with humility. The best systems I’ve seen don’t just optimize for cost. They optimize for adaptability. That means redundancy in key nodes, not everywhere. And trust between suppliers and distributors. No algorithm replaces a good relationship.

Bartholomew Henry Allen

December 31, 2025 AT 00:51Foreign manufacturing is the root cause of supply chain fragility. The FDA inspections are a joke. Chinese and Indian plants operate under different standards. We should bring production back to the United States. National security. Economic sovereignty. End of story. No more outsourcing lifesaving drugs to countries with no rule of law.

Jeffrey Frye

January 1, 2026 AT 09:55the numbers look good on paper but in reality? the people on the ground dont have the training. i worked at a regional distributor. we got the new ai tool. it told us to order 2000 units of metformin. we did. turned out the hospital had switched to a different brand. we got stuck with 18 months of expired stock. no one got fired. the software got a bonus. just saying.

Spencer Garcia

January 1, 2026 AT 22:10Start with forecasting. Then fix inventory. Then connect suppliers. That’s the path. Teva did it. You don’t need a $20M digital twin. You need a good planner who talks to the warehouse. And listens.