What if you could prove a generic drug works just as well as the brand-name version - without testing it on a single human being? That’s not science fiction. It’s the reality of bioequivalence waivers, a smart, science-backed shortcut the FDA lets drug makers use under strict conditions. These waivers save time, money, and avoid unnecessary human testing - but only for certain types of pills. If you’re wondering how generic drugs get approved so quickly, this is one of the biggest reasons why.

What Exactly Is a Bioequivalence Waiver?

A bioequivalence waiver - often called a biowaiver - is when the FDA says: "You don’t need to run a clinical study in people to prove your generic drug behaves the same as the brand-name one." Instead, you can use lab tests on the pill’s dissolution in different liquids to show it’s equivalent. This isn’t a loophole. It’s a formal rule written into federal regulations: 21 CFR 320.22. The FDA only allows this for immediate-release, solid oral dosage forms - meaning regular tablets and capsules you swallow, not patches, injections, or slow-release pills. The goal? To stop wasting resources on human trials when science clearly shows they’re unnecessary. For example, if a drug dissolves quickly and completely in the gut, and your generic matches that behavior exactly in the lab, there’s no reason to give it to volunteers and draw blood for days.The Science Behind the Waiver: BCS Classification

The key to getting a waiver is the Biopharmaceutics Classification System (BCS). It’s a simple way to group drugs based on two things: how well they dissolve in water (solubility) and how easily they pass through the gut wall (permeability). There are four classes, but only two matter for waivers:- BCS Class I: High solubility + high permeability. These are the easiest to waive. Examples include metformin, atenolol, and ranitidine. If your generic matches the brand’s dissolution profile in lab tests, the FDA almost always approves the waiver.

- BCS Class III: High solubility + low permeability. These are trickier. The drug doesn’t absorb well, but if it dissolves fast and your formulation uses the same exact ingredients in the same amounts, you might still qualify.

Why This Matters: Time, Money, and Access

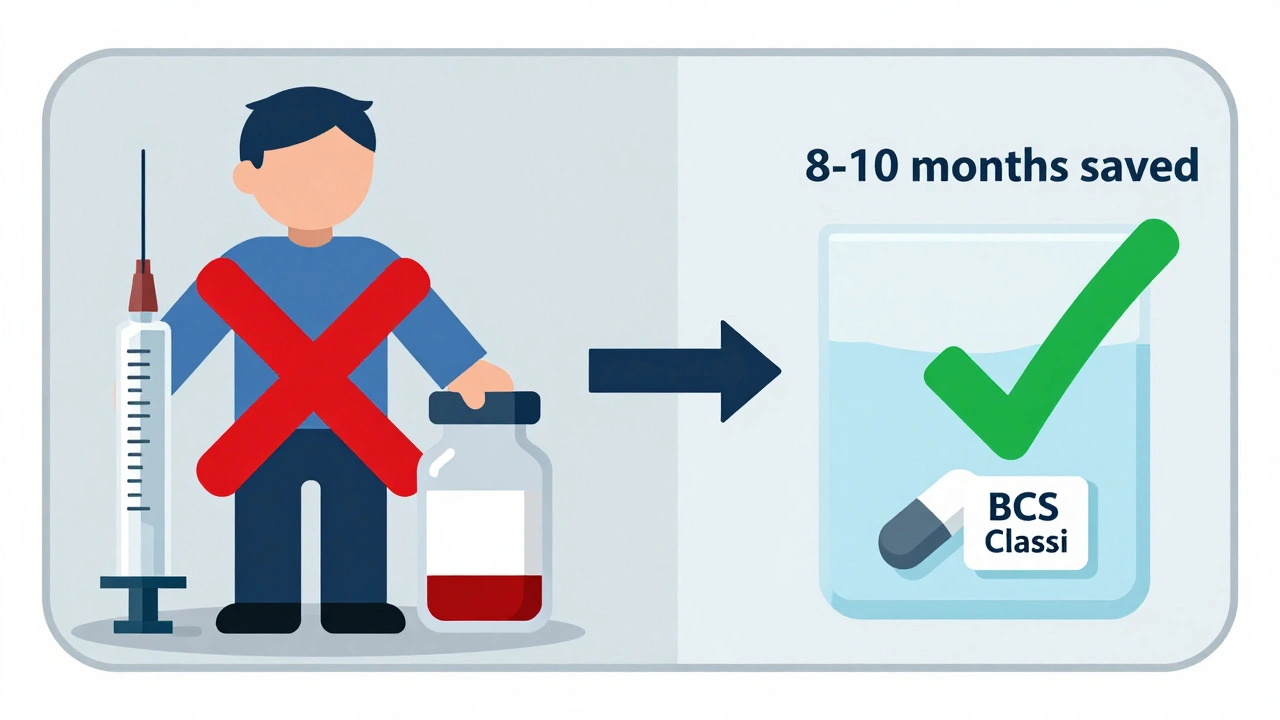

Running a bioequivalence study in people costs between $250,000 and $500,000 and takes 6 to 12 months. That’s a huge barrier for small generic manufacturers. A biowaiver cuts that cost to under $50,000 and reduces approval time by 8 to 10 months per product. In 2022, about 18% of all generic drug applications (ANDAs) used biowaivers - up from 12% in 2018. That’s not a small trend. It’s transforming how generics enter the market. Companies like Teva and Mylan now plan biowaivers into 25-30% of their development pipelines. For patients, that means faster access to cheaper drugs. For the system, it means less strain on clinical trial resources. One formulation scientist reported saving $4.2 million and gaining nearly a decade of approval time across 12 biowaiver approvals over three years. That’s not an outlier - it’s becoming standard practice for the right drugs.

When It Doesn’t Work: The Limits of Biowaivers

Biowaivers aren’t a magic bullet. They don’t apply to:- Modified-release tablets (like extended-release metformin)

- Narrow therapeutic index drugs (like warfarin or levothyroxine), except for a few exceptions like phenytoin

- Drugs with poor solubility (BCS Class II or IV)

- Formulations with complex excipients or unusual manufacturing processes

How to Get a Waiver Approved

If you’re trying to get a biowaiver, here’s what you need to do right:- Confirm BCS class - Use published data or run solubility and permeability tests. Don’t assume.

- Develop a discriminatory dissolution method - Test under pH 1.2, 4.5, and 6.8. Use at least 12 units per batch. Sample at 10, 15, 20, 30, 45, and 60 minutes.

- Match the reference product - Your dissolution profile must be nearly identical. Use the f2 factor. If it’s below 50, you’re not ready.

- For Class III: Match excipients exactly - Same ingredients. Same percentages. No substitutions.

- Request a pre-ANDA meeting - Companies that meet with the FDA before submitting have a 22% higher approval rate. Don’t skip this.

What’s Changing in 2025?

The FDA is slowly expanding the rules. In 2022, they started a pilot program to test biowaivers for certain narrow therapeutic index drugs. In 2023, they released draft guidance to include more Class III drugs, with stricter requirements. Their 2023-2027 strategic plan aims to increase biowaiver use by 25% by refining models that link lab results to real-world performance. That means better science, not just looser rules. Industry analysts predict that by 2027, biowaivers could be used in 25-30% of all generic drug applications - up from 18% today. But they also warn: 85% of complex generics - like patches, suspensions, or inhalers - still can’t use this path. The system works great for simple pills. It’s not ready for everything else.Is This Safe? What About Patient Risk?

The FDA doesn’t approve waivers lightly. Their internal analysis from 2012-2016 showed a 78% approval rate for complete applications - and over 95% of approved biowaivers matched the outcomes of actual human studies. That’s not luck. That’s science. The American Association of Pharmaceutical Scientists confirmed that BCS-based biowaivers have a 95% concordance rate with in vivo results for Class I drugs. In other words, if your pill dissolves the same way in the lab, it behaves the same way in the body. There’s no evidence that biowaivers have led to unsafe generics. The system has been in place for over 20 years. The only risk comes from poor science - like using a dissolution test that’s too weak to detect differences. That’s why the FDA insists on strict methods, not leniency.Final Thoughts

Bioequivalence waivers aren’t about cutting corners. They’re about cutting out the unnecessary. For drugs that dissolve and absorb predictably, human trials add cost and delay without adding safety. The FDA’s system is built on data, not guesswork. And it’s working. If you’re a patient, it means faster access to affordable medicine. If you’re a manufacturer, it means smarter development. If you’re a regulator, it means focusing resources where they matter most - on the complex, risky, or uncertain products. The future of generic drug approval isn’t more human trials. It’s smarter science - and bioequivalence waivers are leading the way.Can any generic drug get a bioequivalence waiver?

No. Only immediate-release solid oral dosage forms - like regular tablets and capsules - qualify. The drug must also fall into BCS Class I (high solubility, high permeability) or sometimes Class III (high solubility, low permeability). Modified-release, injectable, topical, and narrow therapeutic index drugs (except a few exceptions) do not qualify.

How much money can a company save with a bioequivalence waiver?

A standard in vivo bioequivalence study costs between $250,000 and $500,000 and takes 6-12 months. A biowaiver cuts that cost to under $50,000 and reduces approval time by 8-10 months per product. Over a portfolio of 10 drugs, that’s over $3 million saved and years of faster market entry.

What is the f2 similarity factor and why does it matter?

The f2 factor is a mathematical value that compares how closely the dissolution profiles of two drug products match. It’s calculated using dissolution data collected at multiple time points (like 10, 20, 30, 60 minutes). An f2 value of 50 or higher means the profiles are similar enough for the FDA to accept the waiver. If it’s below 50, the products are too different - even if they look identical on paper.

Why are BCS Class III drugs harder to approve for waivers?

BCS Class III drugs dissolve well but don’t absorb easily through the gut wall. Since absorption is unpredictable, the FDA worries that lab dissolution tests might not reflect what happens in the body. Even if your generic dissolves exactly like the brand, it might still be absorbed differently. That’s why the FDA requires identical excipients and extra proof that absorption isn’t affected by where in the gut the drug is released.

What happens if my biowaiver application is rejected?

Most rejections happen because the dissolution method wasn’t discriminatory enough - meaning it couldn’t detect small but meaningful differences between your product and the brand. You’ll need to refine your test conditions, use more time points, or change buffer pH levels. Many companies go back, improve their method, and resubmit. About 78% of complete applications get approved, so rejection isn’t the end - it’s feedback.

Are biowaivers used outside the U.S.?

Yes. The International Council for Harmonisation (ICH) adopted guidelines for BCS-based biowaivers in 2021, and agencies in the EU, Canada, Japan, and Australia now follow similar rules. The U.S. FDA’s guidance is one of the most detailed and widely referenced, but the global trend is toward harmonized, science-based waivers for simple oral drugs.

Inna Borovik

December 6, 2025 AT 18:17Let’s be real - this waiver system works because the FDA trusts the science, not the corporations. I’ve reviewed dissolution profiles for 12 generics last year. The f2 factor isn’t a suggestion - it’s a hard cutoff. If your curve doesn’t match within ±10% at every time point, you’re not getting approved. No exceptions.

And yes, Class III is a nightmare. One client spent $80K on a waiver that got rejected because their excipient had a 0.5% higher lactose content. The FDA didn’t care that it was ‘chemically identical.’ They care about *behavior*.

Also - stop calling this a ‘shortcut.’ It’s not. It’s precision engineering with regulatory teeth.

Rashmi Gupta

December 7, 2025 AT 09:31Interesting. But what if the lab conditions don’t reflect what happens in a diabetic’s gut? Or someone with IBS? The body isn’t a beaker.

I’m not against science - I’m against pretending we’ve cracked human biology with pH buffers and dissolution curves.

Andrew Frazier

December 7, 2025 AT 20:35USA still runs the best pharma regs in the world. China and India are trying to copy this but they can’t even get the dissolution apparatus calibrated right. This is why American generics are still the gold standard - because we don’t cut corners, we cut the BS.

Also, f2 > 50? Pfft. We use 55. Because we’re not amateurs.

Mayur Panchamia

December 8, 2025 AT 20:00Ha! So you’re telling me that after 20 years of testing, the FDA finally figured out that if a pill dissolves the same way in a cup of acid - it works in the body?!?!!

My cousin in Mumbai takes generics every day - and he’s alive. But this? This is still a gamble. The FDA thinks they’re geniuses. But we know better. We’ve seen the side effects. We’ve seen the deaths. And now they want to skip human trials? With Class III drugs? Are you kidding me?!

Wait - let me guess - this is how they save money so Big Pharma can raise prices on the brand version even higher! Classic!

Karen Mitchell

December 9, 2025 AT 15:53This is a dangerous precedent. The FDA is abdicating its duty to protect public health under the guise of ‘efficiency.’ There is no substitute for human data. No algorithm, no dissolution curve, no BCS classification can replicate the complexity of human physiology. This is not innovation - it is negligence dressed up as science.

And let’s not forget: many of these waivers are approved by reviewers who have never even seen a patient. How is this ethical?

Geraldine Trainer-Cooper

December 10, 2025 AT 15:59so like… if the pill dissolves the same in the lab, it dissolves the same in you?

weird

but also… kinda makes sense?

science is cool

Nava Jothy

December 12, 2025 AT 12:25Oh my god, this is *exactly* what I’ve been screaming about for years!! 😭

The FDA is finally listening to the real scientists - not the lobbyists, not the bureaucrats, not the fearmongers. I cried when I read about the f2 factor. It’s not just math - it’s poetry. It’s the language of molecules telling us they’re identical.

And Class III? YES. I’ve worked on three of them. The excipient match is everything. One wrong filler and the whole thing collapses. But when it works? Magic. Pure magic. 💫

Also - why is everyone so scared? We’ve had this for 20 years. Where are the dead people? Where are the lawsuits? The data doesn’t lie. 🤍

Annie Gardiner

December 13, 2025 AT 19:56I love how people act like this is some kind of shady loophole. It’s not. It’s just… good science.

Imagine if we still did live dissections to test every new painkiller. We’d still be in the 1800s.

This isn’t about cutting corners - it’s about knowing when the corner doesn’t even exist.

Also, the 95% concordance rate? That’s better than most medical diagnoses. We should be celebrating this, not fearing it.

Chris Park

December 15, 2025 AT 17:22They’re lying. The FDA doesn’t trust the data - they’re being pressured by Wall Street. This is how they push generics faster so insulin and cancer drugs stay expensive. The dissolution curves? Easily manipulated. The machines? Calibrated to favor approved manufacturers.

And don’t get me started on the ‘pre-ANDA meetings’ - those are pay-to-play backroom deals. You think a small company from Nebraska has a shot? No. Only the big players with legal teams get the ‘tips’.

This isn’t science. It’s corporate capture. And soon, your ‘safe’ generic will be laced with something they didn’t test for.

Trust me. I’ve seen the emails.

Akash Takyar

December 17, 2025 AT 02:20This is a remarkable achievement in regulatory science - and it deserves recognition. The systematic application of BCS principles has transformed global access to affordable medicines. For developing nations, where clinical trials are logistically impossible, these waivers are life-saving.

India, for example, now exports over 40% of its generics using biowaivers - and the safety record remains impeccable. This is not a loophole; it is a triumph of rational, evidence-based policy.

To those who fear change: remember that progress does not mean compromise. It means evolution - and this is evolution at its finest.

brenda olvera

December 18, 2025 AT 19:20Love this. As a Latina mom who’s bought generic blood pressure pills for 15 years - I just want them to work. I don’t care if they tested it on 10 people or 10,000. As long as it’s the same pill inside, I’m good.

And honestly? I’d rather my tax dollars go to helping people get cancer meds than funding 100 people to swallow pills for a month.

Thank you for explaining this so clearly. I’m sharing this with my book club.